This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

MICHAEL D. UMPHREY

SHAREHOLDER

Michael Umphrey is a shareholder, as well as an officer and a director, of the firm. He concentrates his practice in the areas of legacy (formerly estate) planning, business/tax planning and the administration of estates and trusts. He has written, and also frequently lectures, on these subjects.

Mr. Umphrey’s practice involves a wide variety of legacy and business planning/structuring situations. In over 40 years of practice, he has developed a high degree of expertise in the design and drafting of a broad range of legacy planning, business and financial planning documents for a wide variety of clients with differing needs and requirements, ranging from the straightforward and uncomplicated to the most complex situations.

Many legacy planning considerations dovetail closely with business planning matters. Since Mr. Umphrey represents a significant number of family-owned businesses, he has developed a particular expertise in the special needs of the entrepreneurial family.

Given the nature of his practice, Mr. Umphrey also has considerable experience dealing with incapacity situations and with the post-death administration of trusts and estates. His expertise in these areas aids clients in minimizing taxation, expenses, delays and post-death disputes and in providing for the proper management and prompt distribution of deceased clients’ businesses and other assets.

B.A., Albion College, 1964

U.S. District Court for the Eastern District of Michigan

U.S. Tax Court

Oakland County Bar Association

Wayne County Probate Bar Association

Detroit Metropolitan Bar Association

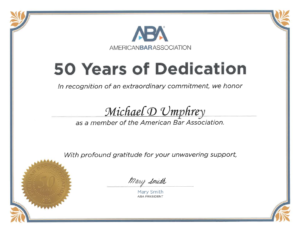

American Bar Association

Federal Estate Planning Council of Detroit

Oakland County Estate Planning Council

Michael Umphrey maintains an “AV” peer review rating with Martindale-Hubbell Law Directory, the highest peer review rating for attorneys.

Mr. Umphrey has been selected by his peers for inclusion in The Best Lawyers in America© 2024 in the fields of Business Organizations (including LLCs and Partnerships), Closely Held Companies and Family Business Law and Trusts and Estates. He has been recognized by The Best Lawyers in America® since 2018.

Mr. Umphrey was selected for inclusion in Michigan Super Lawyers featuring the top 5% of attorneys in Michigan for his work in Estate Planning & Probate.

Michael Umphrey was honored for being a member of the American Bar Association for 50 years. Mr. Umphrey was admitted to the practice of law in 1968 and joined the American Bar Association in 1973.

He has also been designated an Accredited Estate Planner by the National Association of Estate Planners and Councils. In addition, Mr. Umphrey has been named a “Five Star Wealth Manager” by Five Star Professional. The Five Star Award is presented to only 7% of wealth managers with at least five years of experience in the financial services industry, and who are evaluated in the local market to score highest in client satisfaction.

Additionally, Mr. Umphrey was selected by a vote of his peers to be included in DBusiness magazine’s list of Top Lawyers in 2024 in the practice area of Trusts & Estates.

Your Legacy is About Much More Than Money; Commentator

PRACTICE AREAS