Category: Newsletters & Articles

ALTERNATIVE DISPUTE RESOLUTION

The high cost of litigation and number of cases flooding the courts have many judges and attorneys using alternative dispute resolution (ADR) to significantly cut costs and improve the efficiency of the court system. Clients whose cases qualify for this process often find it simpler and easier than facing off in the courtroom.

In Brief

- In general, ADR involves a mediator, arbitrator, or panel of attorneys depending on the type of ADR chosen, who assists the parties in developing their own outcome to their unique disputes.

- Mediation offers the opportunity for both parties to tell their side of the story in an informal and conversational setting as opposed to an exchange of testimonies in court.

- Arbitration is submission of a dispute to one or more impartial persons for a final and binding determination.

Ch 1: Resolving Conflict Outside of Court

The high cost of litigation and number of cases flooding the courts have many judges and attorneys using alternative dispute resolution (ADR) to significantly cut costs and improve the efficiency of the court system. Clients whose cases qualify for this process often find it simpler and easier than facing off in the courtroom.

What are the benefits of Alternative Dispute Resolution?

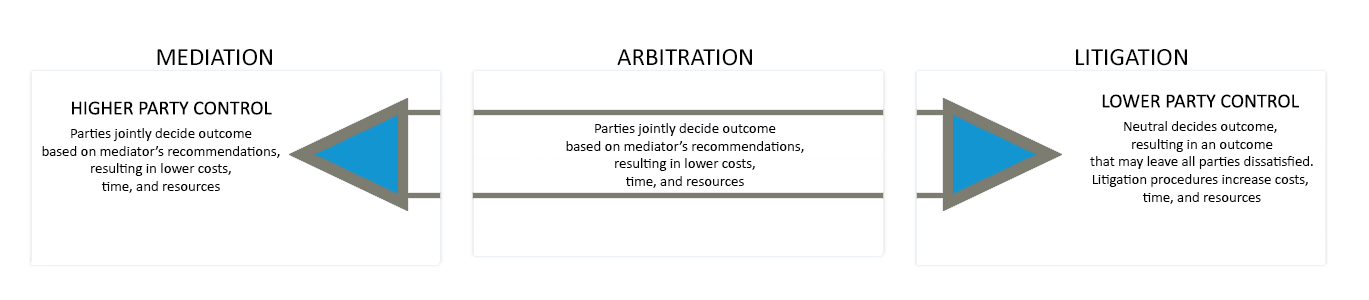

Alternative dispute resolution is an appealing option because it can be applied to virtually any type of civil case. In general, ADR involves a mediator, arbitrator, or panel of attorneys depending on the type of ADR chosen, who assists the parties in developing their own outcome to their unique disputes. Once in the courtroom, parties surrender control over the outcome to the judge who ultimately decides the case.

Reasons to settle disputes outside of court

Aside from the obvious reduction in cost, there are three main reasons ADR is more appealing than the formal litigation process. First, all types of ADR give the parties greater control over the procedure and outcome of their dispute than they would have in a courtroom. Next, in any type of ADR, parties have the freedom to add issues to their dispute when they arise as opposed to the courtroom where parties are tied to the issues stated in their initial pleading. Last, ADR provides the parties with privacy that they would not have if their case were to be heard in court. The courtroom is generally open to the public, meaning anyone can walk into the courtroom and hear every detail of your case. Additionally, any papers that are filed with the court are also open to anyone upon request.

There are several types of ADR. Two of the most commonly used types are mediation and arbitration. I will discuss the details and benefits of each in the following articles with relevant input from Joseph P. Buttiglieri, an attorney with 46 years of experience, 10 of which he has served as a certified mediator. In the meantime, if you are contemplating whether to address a legal issue but don’t want to drag it through the courts, contact us. We can provide information and options to help you move forward.

Ch 2: Mediation, An Informal Alternative

When a dispute arises, whether it be between family members, business partners, landlords and tenants, etc., some are hesitant to pursue court action for a number of reasons with the leading reason being the significant cost of litigation. The mediation process provides parties with an alternative route for conflict resolution that is more cost and time efficient, generally less confrontational, and gives all parties, through the facilitation of the mediator, more control over the final outcome than they would have in court through litigation.

What is mediation?

Mediation is a confidential process where individuals in conflict have the opportunity to be heard, share their ideas for resolution, negotiate such ideas with one another, and come to an agreement that leads to a mutually acceptable resolution. Mediation offers the opportunity for both parties to tell their side of the story in an informal and conversational setting as opposed to an exchange of testimonies in court. A mediator takes on a different role than a judge who makes decisions on behalf of the parties. A mediator assists the parties in communicating their desired outcome to one another, offers suggestions when needed or requested, identifies issues together with the parties, and works with all sides to resolve the identified issues. Mediation allows the parties to have a great deal of influence and control over the decision-making process that leads to the final outcome of their case. In litigation, control over the decision making process is surrendered to the judge who ultimately decides the case in a manner that may leave all parties dissatisfied.

Common misconceptions regarding mediation

A common assumption is that mediation is only available in divorce or family law cases. However, any type of civil dispute can be resolved by mediation. The freedom the parties have in choosing their mediator supports the wide applicability of mediation to virtually any kind of dispute. The parties are able to jointly choose a mediator who is experienced in the specific area of law that their dispute involves and can therefore provide meaningful advice and suggestions in order to reach an outcome that is specifically tailored to the parties’ unique issues. Additionally, because mediation leaves the bulk of the decision making to the parties, who know their case better than any judge would, mediation becomes an appealing option no matter the type of case, as the parties can collectively design their own outcome. Nearly any type of dispute that parties want resolved quickly and inexpensively can be submitted to mediation.

Many people also believe that if parties decide to mediate their case, litigation ceases to be an option. If mediation isn’t progressing in a way that the parties want, the parties can choose to end mediation and bring some or all of the unresolved issues to court for a judge to decide. With this in mind, mediation can be used to consolidate issues before initiating court proceedings as a way to save litigation costs by only bringing the unresolved issues to court. The litigation route also provides a failsafe of sorts for parties in mediation that cannot communicate effectively, despite the assistance of the mediator, and consequently suffer a breakdown in that communication resulting in an unsuccessful mediation. If such a breakdown occurs, the parties can resolve their dispute through formal litigation.

Benefits of mediation

Cost: A primary benefit of mediation compared to litigation is the difference in cost. The litigation process is complex and burdened by procedure that increases attorney fees and costs significantly as attorneys are required to prepare and file documents with the court such as motions, briefs, petitions, responses, etc., attend various court hearings, and go through a lengthy cost-consuming discovery process. In choosing mediation, parties cut the increased costs that litigation often requires. First, the entire mediation process is usually done in one or two full day sessions, depending on the parties’ needs, as opposed to litigation proceedings that can last for months or even years. This almost always reduces costs in addition to saving time. Second, Parties are able to choose their own mediators so they will know that the mediator’s hourly rate immediately and can better gauge how much mediation will cost from the outset. Third and finally, each party submits a mediation summary that gives the mediator the context of the parties’ respective issues. Filing one mediation summary as opposed to the numerous pleadings that are normally filed in litigation proceedings, is itself an enormous reduction in cost.

Maintaining Relationships: If preserving the relationship amongst the parties is a goal, mediation will most likely provide a better outcome than litigation would. According to Joseph P. Buttiglieri, “Mediation is a gentler, less confrontational approach to resolving conflict as opposed to litigation.” In any case, mediation provides better prospects for repairing the relationship between parties as they are free to work together to resolve their issues. In any case, mediation provides better prospects for repairing the relationship between parties as they are free to work together to resolve their issues.

Flexibility: Mediation is less constricting with regard to bringing up new issues. In litigation, the parties are bound by the issues set forth in the pleadings and are restricted from arguing any other issues not in the pleadings. In mediation, parties are free to bring any issues and bring-up new issues as mediation unfolds that can then be addressed and resolved in the same mediation session.

If you have questions about the mediation process or alternative dispute resolution in general, contact us. We can discuss the various options available to you concerning the specifics of your dispute and can offer suggestions for the efficient and effective resolution of your case.

Ch 3: Arbitration, A Formal Alternative

Arbitration is submission of a dispute to one or more impartial persons for a final and binding determination. In comparison to mediation and litigation, arbitration sits in the middle as being a more formal process than mediation but still less formal than litigation.

Differences between arbitration and mediation

In most cases the courts can mandate mediation. Arbitration, however, can only be mandated by the court if the parties enter into a contract that mandates arbitration. If no contract exists between the parties, the parties themselves can choose to arbitrate their dispute, but a court cannot mandate it.

The roles of the arbitrator and mediator are very different. An arbitrator has the power to render a binding decision in the case at hand. The arbitrator effectively replaces the judge or jury as the decision-maker. A mediator, however, works cooperatively with the parties and their suggestions as to resolution can be either accepted or rejected by either party.

The roles of the arbitrator and mediator in the discovery process also differ significantly. In mediation, the mediator obtains information by, first, the mediation summary that each party to the dispute submits which briefly outlines their argument and lays out the basic facts of the case. At mediation, the mediator conferences with each party separately to obtain more information. Arbitration on the other hand, is first controlled by the contract between the parties if one exists. The arbitration provision(s) in the contract can guide the arbitrator as to what types and quantity of discovery is permissible. If the contract is silent or no contract exists, the parties can meet with the arbitrator prior to the initial hearing in a case, and orally agree as to the discovery parameters they would like to follow. There are also governing arbitration rules that exist to serve as a guide to both arbitrators and parties when forming their discovery agreement.

Common misconceptions regarding arbitration

One of the most common misconceptions concerning arbitration is that decisions from a lawsuit through the litigation route are more enforceable than arbitration awards. Although arbitration awards occur outside the courtroom, they are still enforceable in a judicial forum. Federal and state arbitration acts require courts to not only recognize, but enforce arbitration awards, even if entered in different states. Additionally, because Treaties require foreign courts to enforce arbitration awards entered in another country, the arbitration awards can be as effective as a civil judgment when it comes time to enforce such awards.

Another misconception that many have concerning arbitration is the cost of arbitration. As discovery proceedings can sometimes mirror discovery in litigation, some people think that arbitration is much more costly than mediation and on par with the cost of litigation. The cost of arbitration, however, is very similar to the cost of mediation in that both sides pay for their own counsel and they each usually share an equal amount in cost for the arbitrator. Additionally, although discovery can be costly, the freedom to set up the discovery parameters by the parties and arbitrator can cut the cost of discovery making it at times, much less than the discovery cost in litigation.

Benefits of arbitration as an alternative to litigation

Efficiency: In comparison to litigation, the resolution of a dispute can happen much sooner through arbitration. Litigation in some cases may take several years to resolve where in contrast, an arbitration award can be reached within months of the start of the arbitration process. Arbitration is also more cost-efficient than litigation. Aside from the lower discovery costs explained above, arbitrators, like mediators, usually bill by the hour or day at similar rates charged by attorneys. This significantly reduces the costs when compared to the cost of litigating a case or dispute. Additionally, because resolution of a dispute generally happens sooner in arbitration than litigation, the attorney fees are significantly reduced. Even though the courts only charge filing fees, litigation can still be more expensive due to scheduling issues, time and cost involved in the attorneys traveling to the courthouse, and the high amount of pleading filed in any given case. Issues that are raised in arbitration proceedings can be communicated to the arbitrator through a phone conference, email correspondence, or a letter, all of which have no filing fees associated with them.

Privacy: Arbitration proceedings occur in private unlike trials in court which are open to the general public. Any information discovered and used in arbitration proceedings can be kept confidential. Hearings before the arbitrator and the final resolution or award can also be kept private and are just between the parties and the arbitrator. In a trial, the general public is able to access information in the case and attend hearings.

Less Complex: The admittance of evidence is generally simpler in arbitration than the complex process that exists in litigation. The normal rules of evidence used in court proceedings have limited applicability in arbitration proceedings as the arbitrator has broad power to decide what evidence is allowed. Additionally, the lengthy and complex process of discovery in litigation is generally bypassed in arbitration as the parties together with the arbitrator generally decide the process for discovery.

Finality: Because the arbitrator effectively replaces the judge and jury as the decision-maker, it severely limits the parties’ right to appeal the award. In contrast, a court’s decision in a case can be subject to appeals that can add months if not years to the final resolution of your case. The binding decision of the arbitrator gives the parties in dispute finality as to the issues they raised during arbitration as the decision or award is rarely appealable.

If you have questions about the arbitration process or alternative dispute resolution in general, contact us. We can discuss options that will help your case move forward in the most efficient and effective way possible.

Three Reasons to Resolve Conlict Outside of Court

The high cost of litigation and number of cases flooding the courts have many judges and attorneys using alternative dispute resolution (ADR) to significantly cut costs and improve the efficiency of the court system. Clients whose cases qualify for this process often find it simpler and easier than facing off in the courtroom.

What are the benefits of Alternative Dispute Resolution?

Alternative dispute resolution is an appealing option because it can be applied to virtually any type of civil case. In general, ADR involves a mediator, arbitrator, or panel of attorneys depending on the type of ADR chosen, who assists the parties in developing their own outcome to their unique disputes. Once in the courtroom, parties surrender that control over the outcome to the judge or jury to ultimately decide the case.

Reasons to settle disputes outside of court

Aside from the obvious reduction in cost, there are three main reasons ADR is more appealing than the formal litigation process. First, all types of ADR give the parties greater control over the procedure and outcome of their dispute than they would have in a courtroom. Next, in any type of ADR, parties have the freedom to add issues to their dispute when they arise as opposed to the courtroom where parties are tied to the issues stated in their pleadings. Last, ADR provides the parties with privacy that they would not have if their case were to be heard in court. The courtroom is generally open to the public, meaning anyone can walk into the courtroom and hear every detail of your case. Additionally, any papers that are filed with the court are also open to anyone upon request.

What is the difference between mediation and arbitration?

There are several types of ADR. Two of the most commonly used types are mediation and arbitration. We will discuss the details and benefits of each in future articles with relevant input from Joseph P. Buttiglieri, an attorney with 46 years of experience, 10 of which he has served as a certified mediator. In the meantime, if you are contemplating whether to address a legal issue but don’t want to drag it through the courts, contact us. We can provide information and options to help you move forward.

Business Buyers Face Expanding Liability Risks

Business Buyers can find themselves with an unexpected, expensive surprise when a court makes them pay up for the Seller’s liabilities, especially employment law violations. A recent case expands the list of Seller liabilities that a Buyer could end up paying the bill for. Buyers should carefully plan to assess and mitigate those risks, especially if the Seller is experiencing financial difficulty.

Generally, the Buyer of a corporation’s assets does not assume the Seller’s corporate liabilities. But there are exceptions to the rule. The Supreme Court imposes successor liability on asset Buyers in employer-employee contexts. Specifically, a Buyer may be bound by a Seller’s collective bargaining agreement or liable for a seller’s unfair labor practices. Other Federal Courts have expanded the doctrine of successor liability to delinquent pension fund contributions under ERISA, the Fair Labor Standards Act (minimum wage and overtime), the Family and Medical Leave Act, and Title VII of the Civil Rights Act.

A court looks at two things before it imposes successor liability on a Buyer:

- the Buyer’s awareness of the Seller’s liability;

- a substantial continuity of identity in the business enterprise.

There are no hard and fast rules when it comes to evaluating substantial continuity. It depends on all the circumstances, but courts typically look at the similarity of the new business to the old, as well as the type of liability at question.

Recently, a Second Circuit Court was asked to expand the doctrine of successor liability to hold an asset buyer liable for its predecessor’s withdrawal liability under the Multiemployer Pension Plan Amendment Act (MPPAA). The MPPAA amended ERISA to provide that if an employer withdraws from a multiemployer plan, it is liable for its portion of unfunded vested benefits. This was adopted to reduce the burden on the plan and remaining participants, protect the financial solvency of multiemployer plans, and to ensure employees do not lose their retirement benefits.

In New York State Teamsters Conference Pension and Retirement Fund V. C&S Wholesale Grocers, Inc., 24 F.4th 163 (Jan. 27, 2022), the Defendant, C&S, bought most of the assets of Penn Traffic, a grocery wholesale business, excluding a warehouse in Syracuse and the warehouse employees who were members of the Plaintiff multiemployer union. Penn Traffic continued to operate the Syracuse warehouse and employ the Plaintiff union member employees. Penn Traffic went bankrupt and pulled out of the Plaintiff multiemployer pension plan, creating significant withdrawal liability. The Plaintiff sued to collect Penn Traffic’s withdrawal liability from C&S on the doctrine of successor liability. The Court easily found that an asset Buyer could be liable for a Seller’s withdrawal liability under the doctrine of successor liability. Because Federal Courts already used the successor liability doctrine to make Buyers pay for Sellers’ delinquent pension fund contributions under ERISA, the Court had no trouble expanding the reach of successor liability to include withdraw liability under the MPPAA. In the Court’s words:

The primary reason for making a successor responsible for its predecessor’s delinquent ERISA contributions is that, “absent the imposition of successor liability, present and future employer participants in the union pension plan will bear the burden of the predecessor’s failure to pay its share,” which will threaten the health of the plan while the successor reaps a windfall. That rationale applies with equal, if not greater, force to a predecessor’s MPPAA withdrawal liability.

But the case also contains good news for Buyers: the Court held that C&S could not be liable for Penn Traffic’s withdraw liability, because C&S did not buy the Syracuse warehouse and did not hire the employees who work there (the withdrawal liability related to those employees). Because C&S was not Penn Traffic’s successor to that business it was not on the hook for Penn Traffic’s withdraw liability.

Buyers should carefully investigate and assess employment related exposures as part of due diligence. And when risks pop up, Buyers should mitigate them appropriately. If the Teamsters opinion tells us anything, one way to do that is to carve out riskier business units altogether. Sometimes that’s not practical, and that’s when a quality legal team can help you control the risk.

For further information regarding these matters, please contact Kemp Klein.

Digital Legacies: A Modern Necessity in A Digital World

With so many hours spent on email, social media and other internet activities, it might feel as if your whole life is lived online. But have you ever wondered what will happen to your accounts and photos when you pass away? How will loved ones communicate about your passing, access photos of you, or wrap up unfinished business? The simple answer: you can leave instructions describing your wishes.

Written instructions in your estate planning documents can help your executor or trustee access your digital legacy post-death. A digital legacy may include accounts on Facebook, LinkedIn, Instagram, or Twitter as well as blogs, licensed domain names, music, photos, files you store online and access to financial accounts.

In recent years, laws have been enacted to facilitate the transfer in ownership of digital accounts. The most notable of which for Michigan residents is the Revised Uniform Fiduciary Access to Digital Assets Act (“RUFADAA” or the “Act”). This Act provides individuals an ability to empower a fiduciary – such as an executor or trustee – to receive disclosure of the individual’s digital assets from the entity that runs or operates the account (also known as the “custodian” of the account). For example, Apple is the custodian of iCloud.

Under the Act, a properly empowered fiduciary would have the ability to petition the account’s custodian for access to the deceased’s account and its contents. Critically, the access granted pursuant to RUFADAA must be in the form of the deceased individual expressly authorizing access within their will, trust, or power of attorney.

The process of efficiently and adequately transferring many digital assets is still in its infancy. With this in mind, there are proactive steps an account owner should take while still alive to expedite access to digital accounts once deceased. For example, it is one thing to have the legal authority to gain access to an account, and quite another to have current direct access with username and password to identify and unlock the account. Thus, it is advantageous to also provide the fiduciary with login information for digital accounts.

Putting login names and passwords in writing does not come without a degree of risk, and caution should be utilized in sharing this sensitive information. If you have concerns about providing your fiduciary with account login information while you are still living, you should discuss safeguard options with your estate planning attorney. At a minimum, the fiduciary should have a username, or the equivalent, to identify the account in question to petition for access.

While the RUFADAA is useful, it is even more advantageous if the fiduciary does not have to rely on the Act at all. This can be done by using online tools directly through the account custodian. These online tools are a relatively new phenomenon but are becoming increasingly commonplace, as account custodians grapple with how to adequately balance account owner privacy against many owners’ desires to transfer digital accounts and contents once the owner is no longer living.

The functionality of these online tools varies from custodian to custodian, but the intent broadly remains the same. At its core, an online tool provided by a custodian allows an account’s owner to identify individuals that are permitted to access the owner’s account in the event of the owner’s death.

One of the more robust versions of this can be found in Google’s Inactive Account Manager. There, the account owner can decide on a time period of inactivity, at the end of which the Inactive Account manager kicks in. The owner also identifies up to ten people that are to be notified once the period of inactivity has run. The tool applies to all Google products, meaning that the owner can choose which of the identified people receive access to which accounts.

Another notable online tool is the Apple iCloud Digital Legacy, a recent addition to Apple software. There, the iCloud account owner can choose up to five people that can access and download the account’s data after the owner’s death. This has been a highly sought-after feature because users often store the bulk of their pictures in the cloud, often making those memories difficult to access following the death of the account owner.

As our lives become further documented online, it is imperative that you work with your estate planning attorney to ensure digital accounts are included in a comprehensive estate plan. A combination of proper estate planning techniques and use of custodian online tools will help to ensure your digital legacy is accessible to your loved ones.

To see how our Estate Planning Group can assist:

www.kkue.com/services/estate-planning

For further information regarding these matters, please contact Mr. Callahan at 248 740 5683 or via email.

What to Know About Gun Laws In The Wake of Oxford

In late 2021, Michigan was shaken by the Oxford High School shooting. The tragedy of that event has sparked debate around firearm ownership, use, storage, and the potential for liability. Heated discussions are occurring on the state and federal levels.

Numerous bills by Michigan Democrats and Republicans were introduced in the 2021 session. Proposed changes range from requiring universal background checks to repealing the pistol registry to allowing residents to concealed carry without a permit.

It can be a dizzying experience trying to follow the debate over firearm legislation. So, we prepared an overview of proposed legislation at the federal and state levels as well as a brief comparison to Michigan’s current firearm laws.

On the Federal Level:

In late December 2021, U.S. Representative Elisa Slotkin of Michigan’s 8th Congressional district promised to introduce what has been called the “Safe Guns Safe Kids Act.” In the press, she has said the Act would seek to impute liability and criminal penalties upon gun owners that do not secure their firearms. Slotkin has stated “If a child goes on to commit a crime or hurt others, you could be liable, you could be held accountable criminally for up to five years in prison.” Locally, Michigan Attorney General Dana Nessel released a statement in support of the Act.

On the State Level:

In Michigan, a number of new bills have been introduced in the House and Senate.

House Bills 5627 and 5628 as well as Senate Bills 785 and 786 seek to prohibit the sale or possession of a magazine capable of holding over 10 rounds. Violation of these bills, should they become law, amount to a misdemeanor punishable by a fine of up to $500.00 or 90 days in jail. However, a subsequent violation would be categorized as a felony, punishable of up to a $5,000.00 fine or two years in prison. A person who already owned a magazine exceeding 10 rounds would be able to keep it so long as it was reported to the person’s local law enforcement agency. Currently, Michigan has no specific laws which place a limit on magazine capacity.

Much like Slotkin’s proposal, House Bills 5066 and 5069 as well as Senate Bills 550 and 553 have been introduced to require anyone who stores a firearm in an area that may be accessible by a minor to (a) secure the firearm with a locking device; (b) store it in a lock box; or (c) “keep it in a location that a reasonable person would believe is secure”. If these bills were to become law, a failure to abide by them would be a felony punishable of up to 5 years in prison if the minor uses the firearm to hurt, injure, or kill anyone, including themselves.

Currently, Michigan has no specific law regarding storage of firearms. However, MCL 28.435 does require that any licensed Federal Firearms Dealer include (a) a commercially available trigger lock or (b) other device designed to prevent discharge or (c) a commercially available gun case or storage container to prevent access to the firearm when the dealer sells a firearm.

Senate Bills 454-456 as well as House Bills 4869-4871 seek to impose a universal background check for anyone attempting to purchase a firearm. This legislation would extend a licensing process currently only utilized for handguns (pistols). Michigan currently has no specific licensing requirement for purchase of a long gun.

Alternatively, Senate Bills 489-492 and House Bills 5364-5367 seek to allow residents to carry a concealed weapon without a permit. This type of structure for a state is colloquially known as a “constitutional carry.” Currently, Michigan requires a permit to carry a concealed weapon.

Senate Bills 646-648 and House Bills 5312-5314 are aimed at repealing the Michigan Pistol registry. The bills also seek the destruction of existing records unless held for an ongoing criminal matter or civil lawsuit. Michigan currently requires that handguns be registered with the county or police.

State Level Bipartisan Bills:

Senate Bill 678-679 and House Bill 5371-5372 seek to prohibit any individual that is convicted of a domestic violence misdemeanor from possession of a gun or ammunition for 8 years from the date of (a) payment of all fines and (b) completion of any jail time or probation.

No matter what side of the proposed legislation you are on, there are some basic safety techniques that can be used when dealing with firearms. The Michigan Department of State Police has issued some guidance on use and storage of a firearm in the home environment.

These tips include:

- Having a discussion with family members regarding safe and unsafe use

- Treating every firearm as if it is loaded

- Unloading a firearm when it is not in use

- Keeping ammunition and the firearm out of the reach of children

- Using proper eye and ear protection when using a firearm

Throughout 2022 we may see some movement on a few of these proposals. Many of us will be watching closely. We hope that everyone has a safe and prosperous new year.

When questions or concerns arise about legislation, all citizens have the option to write or call local representatives. Contact information for Representatives can be found at: SOM – Legislature Contacts (michigan.gov)

For further information regarding these matters, please contact Mr. Probst at 248 740 5680 or via email.

Family Matters: How To Help A Friend Or Family Member Who Is Considering Or Going Through A Divorce

There comes a time when a person considering or going through a divorce decides to break the news to friends or family. You may find yourself asking how to support a friend going through divorce or how to help a family member going through divorce. There are certain things you can do if a friend or family member decides to confide in you:

- Listen. The first (and often, best) thing that you can do is listen; in my more than 30 years dedicated to the practice of family law, my clients tell me that the people they hold most dear months – and even years – later, are the ones who were there to “lend an ear” when it was most needed.

- Let them talk. Don’t interrupt; let them tell you what they want to tell you before you ask any questions.

- Offer non-judgmental support. When it’s time for you to speak, offer support without judging the person or the potential/soon-to-be ex-spouse. Most people are feeling exceptionally fragile at this time; saying things like “I thought something was going on” or “it’s about time” might make you feel better momentarily, but it may be damaging to the person who still feels ambivalent. After all, it has to be an individual decision and by offering support – rather than judgment – you can encourage individual decision-making without the interference of your opinion.

- Don’t compare. You won’t be doing the person any favors if you make pronouncements about others’ divorces as if one divorce can be closely analogized to another. Every divorce is fact-specific and dependent upon any number of variables, including income, property, children, length of the marriage, and so much more.

- Keep things confidential. Don’t betray the person’s confidence by telling friends or family members what you just heard. If they want other people to know, they will decide who to tell, and when. This is not your news to share.

- Be the friend they’re counting on you to be. If this same person just received a serious medical diagnosis, you’d probably tell them to get a second opinion from a qualified expert. That’s also good advice for anyone considering a divorce. Knowledge is power, and lack of knowledge can keep a person in an unhealthy, stagnant situation. Encourage the person to seek professional legal advice. That’s because relying on opinions of those without legal experience – however well intentioned – may unintentionally and needlessly exacerbate the situation. An initial, no-cost, fact finding discussion with a Family Law attorney will help them get a sense for what they can reasonably expect in terms of options, end results and cost.

My number one priority as a family law attorney is to help my clients understand the divorce process and the impact of their decisions will have on them and on any children they may have. After that, it’s to help them achieve the best possible outcome going forward. People need to seek information related to his or her particular case, and not rely upon lay opinions, stories based on dissimilar facts, or the internet.

Note: This article is not intended to take the place of legal counsel, nor should it be considered personal legal advice. It is solely intended to provide information about the issues that may arise when contemplating divorce. Call for an appointment and I will be pleased to have a preliminary discussion with you about your specific situation.

For further information regarding these matters, please contact Ms. Stawski at 248 619 2590 or via email.

Snapchat, School, Free Speech and... Cheerleading?

Free speech has become a ubiquitous topic of discussion given the political landscape of the country, the pandemic, and the way information is disseminated. In the summer of 2021, the Supreme Court of the United States decided a case that involves an integral intersection of social media, free speech, and modern American life. The case, Mahanoy Area School District v. B.L., grapples with the first amendment, school regulation of speech, and among other issues, Snapchat.

In 2016, Brandi Levy (“B.L.”) tried out for her high school varsity cheerleading team. However, she was notified that she did not make varsity and instead was placed on the junior varsity team. After she received the news, B.L. was angry with the decision and, over the weekend, she posted a picture of herself on the popular social media platform Snapchat with a caption utilizing expletives regarding school and cheerleading. She posted from a local convenience store, similar to a 7-11. The photo was visible to many, including other students and cheerleaders. The photo was screen captured and saved. Several of the students who saw the post approached school staff, including the cheerleading coaches, saying that the post was inappropriate and that it upset them. The staff decided that the post violated school rules and policy. Accordingly, B.L. was then suspended from cheering on the junior varsity team for a full year. The school athletic director, principal, and the school board affirmed her suspension.

After B.L. was suspended, she (by and through her parents) filed suit in federal court alleging, among other things, that the school had unconstitutionally punished her free speech, which was made outside of the school. The federal district court (trial court) ruled in her favor, finding that the school violated her first amendment rights. The school appealed, and the U.S. Court of Appeals for the Third Circuit affirmed the district court’s decision. The Supreme Court of the United States granted certiorari and heard the case via ZOOM on April 28, 2021.

During oral argument, the Court grappled with prior precedent contained in Tinker v. Des Moines Independent Community School District. The Tinker case dealt with the speech of students wearing black armbands in protest of the Vietnam War at school. That case was decided in 1969, well before the invention of social media, creating a complicated interaction between modern technology and traditional education, particularly considering that none of the justices involved in the Tinker decision are still serving on the Court. The Court was quick to point our that it “was not interested in writing a treatise on free speech.” It was clear during the several hour argument period that the court was toiling with arguments related to the location of the speech, the platform, the timing of the speech (off school hours), and how the Tinker test of “material disruption to class work” was to be applied. It was clear that the speech did not rise to the level of bullying or harassment, which are clear circumstances that implicate a school’s regulatory interests.

In its opinion, the Court addressed the fact that schools may rarely stand in loco parentis when a student speaks off campus, that the court had to be careful about extending schools regulatory authority to a full 24-hour day, and that the school has an interest in protecting unpopular expression as America’s public schools are nurseries of democracy. Ultimately, in an 8-1 decision, the Court sided with B.L., finding, among other things, that the speech was not obscene, did not incite violence, and were she an adult, she uttered the kind of speech that would surely afford her First Amendment protection. The fact that the speech was made on a private device was also mentioned. Only Justice Thomas dissented and argued that the Court ignored 150 years of history supporting the coach and schools’ ability to regulate off campus speech. He took issue with the Court’s manner of ruling and the generic rule, which he enumerates as “Schools can regulate speech less often when the speech occurs off campus.” Frankly, the issue itself is somewhat moot given the fact that B.L. has since matriculated from high school and is in college. This case is a perfect microcosm of a larger set of issues that will stem from social media, internet technology development, and globalization in the law. However, a singular piece of wisdom uttered during the early days of internet popularity continues to ring true: take care to consider the ramifications of online content prior to posting.